Free and Low-Cost Online Accounting Management Software for Metal Clay Artists

Whether you are new to metal clay, a seasoned pro, or somewhere in-between, accounting is an essential element of running your own business. If you don’t already have an accounting system, aren’t happy with your current system, or just don’t know where to start, this article is for you.

It makes sense to maintain some sort of accounting system when you are running a business. You need to track cash in and cash out and all the sales and income tax reporting that goes with that to ensure you keep within the laws of your country. You also need to manage materials inventory on hand and to coordinate procurement for future projects to maximize any volume discounts and minimize shipping costs.

In addition to tracking time and materials used to create your product, there are a host of other expenses you may need to keep track of for tax purposes. These include variable costs and fixed expenses, depreciation, deductions, etc. Software solutions are created to minimize your time spent on record keeping so that you have more time to create, while still complying with your reporting requirements.

This can feel like a daunting undertaking, but it quickly becomes easier over time. Talking to a tax professional proficient in working with small businesses is time well spent prior to setting up your own system.

They can advise you on what types of accounting and inventory software coordinate well with tax preparation software and may even help you to set things up.

If you have an accountant, they may have a preferred system and it pays to ensure the system you choose works seamlessly with your accountant.

Why is any of this necessary? Transitioning a much-loved and profitable hobby into a business takes dedication, determination, and documentation. Income and expenses must be monitored. Inventories must be maintained. Profits and losses must be managed.

Keeping complete and trackable records is vital, especially in the event that the business is audited. For some microbusinesses, handwritten or spreadsheet records may be sufficient. As a business grows, it helps to have a more broad-based, but manageable, accounting system.

Just as there are different types of metal clay artists with various management needs, there are different accounting methods and solutions basically falling under two very broad primary categories: Digital and Manual. The Digital category can be further divided into Standalone Software and Cloud-Based Software.

This article will focus on cloud-based accounting software options. With cloud-based software systems, your business data resides on a vendor’s server, and you access it via either a web browser or an app installed on your local computer or mobile device. In addition to a computer or mobile device, you will need:

- an internet connection

- to diligently access and update your data via a web browser or app installed on your local computer or mobile device.

These cloud-based software solutions offer:

- overall ease of use

- managed administration of updates and enhancements

- portability

- scalability

- the benefit of having your data backed up and saved to the cloud.

Some of these software solutions are available for free, while others charge a fee for service, depending on your preference of features. Nearly all cloud-based fee-based software solutions offer a free trial period.

Accounting System Features

What kinds of features should you consider when shopping for an accounting system?

While there are very few software options customized for handmade microbusinesses and solopreneurs, most are general accounting in nature and can be modified or customized to suit the needs of your business. We, as metal clay artists, are accustomed to adapting tools from other industries, such as the dental industry, to name just one example. Software tools are no different, as long as they meet your needs and your wallet.

Listed below are a few Accounting and Inventory Management software features to get you thinking about what you may want to consider in determining your own needs.

- Single or double-entry accounting

- Income and expense tracking

- Customized invoicing

- General ledger (profit and loss)

- Accounts payable and receivable

- Banking integration, the ability to automatically import your bank transactions so you can categorize them.

- Third-party integrations for payables, payroll, etc. or for sales channels

- Point of sale integration (POS) / credit card and online payment links

- Expense management, time and materials tracking, pricing

- Report generation with graphic display (bar charts, pie charts, etc.)

- Tax management (sales tax, depreciation, tax deductions, etc.)

- Ease of sharing with your bookkeeper or accountant

- Inventory/asset management of both raw materials and finished work in inventory (with photos)

- Contract management (retail/wholesale/consignment)

- Budgeting

- Project management

- Traceability and compliance

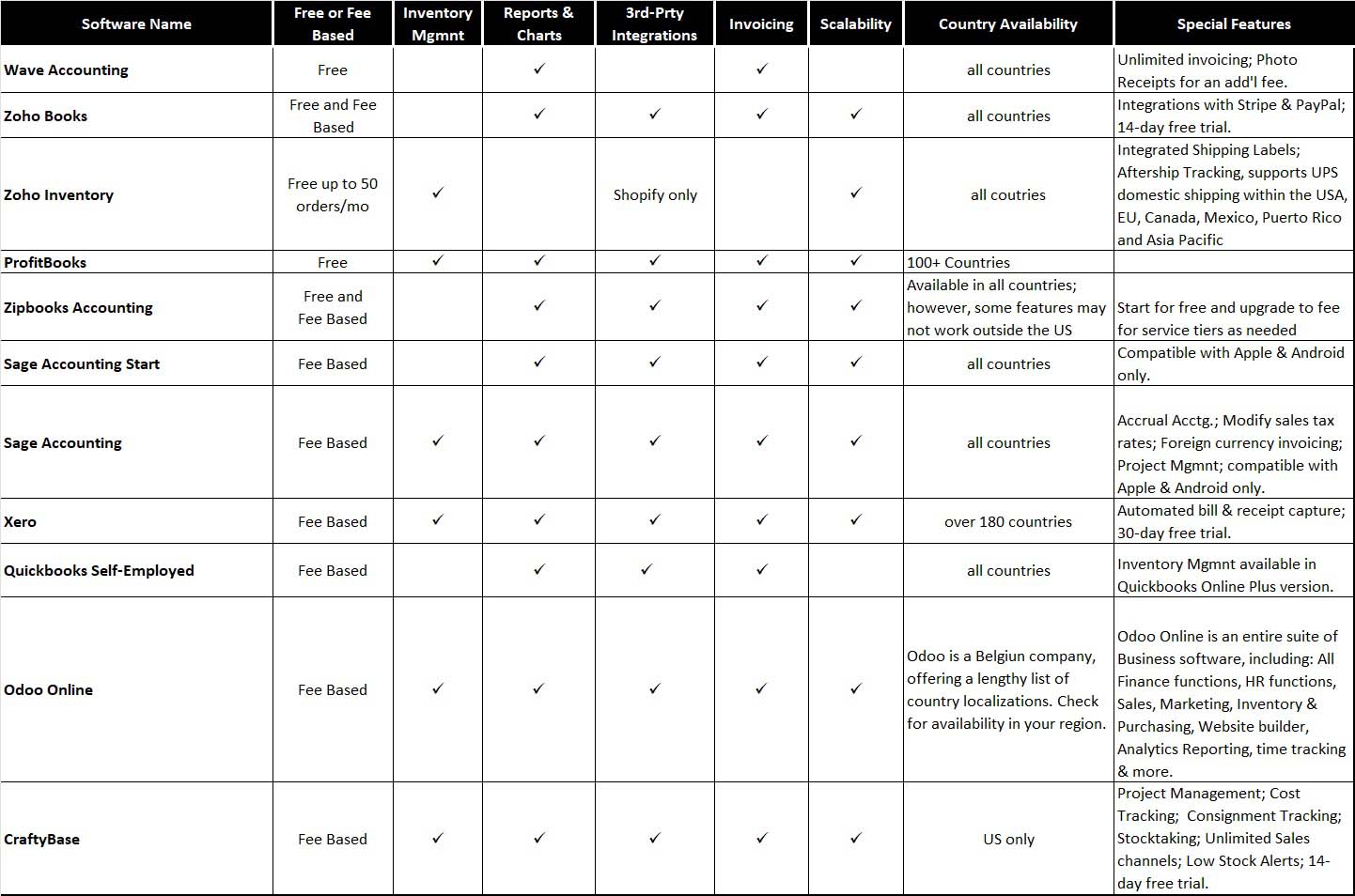

As you begin shopping for an accounting software solution, you will undoubtedly think of other features that may be helpful to you. Here is a basic side-by-side comparison of free and low-cost accounting solution ideas.

Free and Low Cost Accounting Software Solutions Comparisons: